AI Co-Pilot Project

Managing alerts effectively is critical for financial institutions to stay compliant and mitigate risks. However, current tools often fall short, making it difficult for teams to work efficiently and confidently. This project explores the key challenges users face and outlines how our AI-driven solutions can transform the process.

Background

Our current system for managing alerts has some challenges that make it harder for bank analysts to work efficiently. For example, there’s no consistent way to write up summaries about a transaction alert. This makes decision-making slower and more complicated per analyst, and it can lead to unnecessary work due to false alarms.

We planned to use a combination of machine learning and AI to simplify these processes. By automating the creation of alert summaries, we can help teams save time, reduce mistakes, and focus on more important tasks. AI-generated summaries will give users quick, consistent insights, while smarter risk scores will provide more accurate and trustworthy information. This research will help us address user concerns, build trust in AI tools, and ensure the solution truly works for the people who rely on it.

Research Objectives

Alerts/Narratives

Understand how users currently navigate and manage alert workflows

Understand current pain points in alert management

Identify pain points in generating narratives

Investigate how users handle false positives today

Scores

Understand how users currently interpret risk scores

Identify pain points in using/understanding scores

AI

Gather general feedback on level of trust and decision-making process using AI

Evaluate user trust in AI-generated narratives and risk scores

Identify improvements in user workflow with the introduction of AI features

Part 3 Iteration/Prototypes

After talking to 8 customers and having a better idea of how they currently used our product as well as initial feedback on some early designs, I continued to work with Product Manager/Developers to iterate on the initial design while keeping in mind technical feasibility and constraints.

User Research/Discovery

Part 1 - Research

General

What role do you hold at your institution?

How many members are on your team?

What does a typical working day look like?

Alert Specific

Can you walk us through your typical workflow of looking at alerts and actioning them?

When looking at an alert, how do the risk score and comments factor into the disposition process?

What factors make it clear that an alert is a false positive? How do you currently handle them?

Is there anything about the current workflow that slows you down?

Part 2 Initial Designs

Do you see yourself using the AI recommendation column? Why or why not?

Do you see yourself using the AI alert score column? Why or why not?

What do the badges communicate to you under the AI recommendation column?

What are you expecting to find in this alert based on the “send to case” tag”?

Does the interface feel familiar, unfamiliar?

Does the AI narrative contain the information you would expect to find useful for your disposition?

Part 4 Additional Research

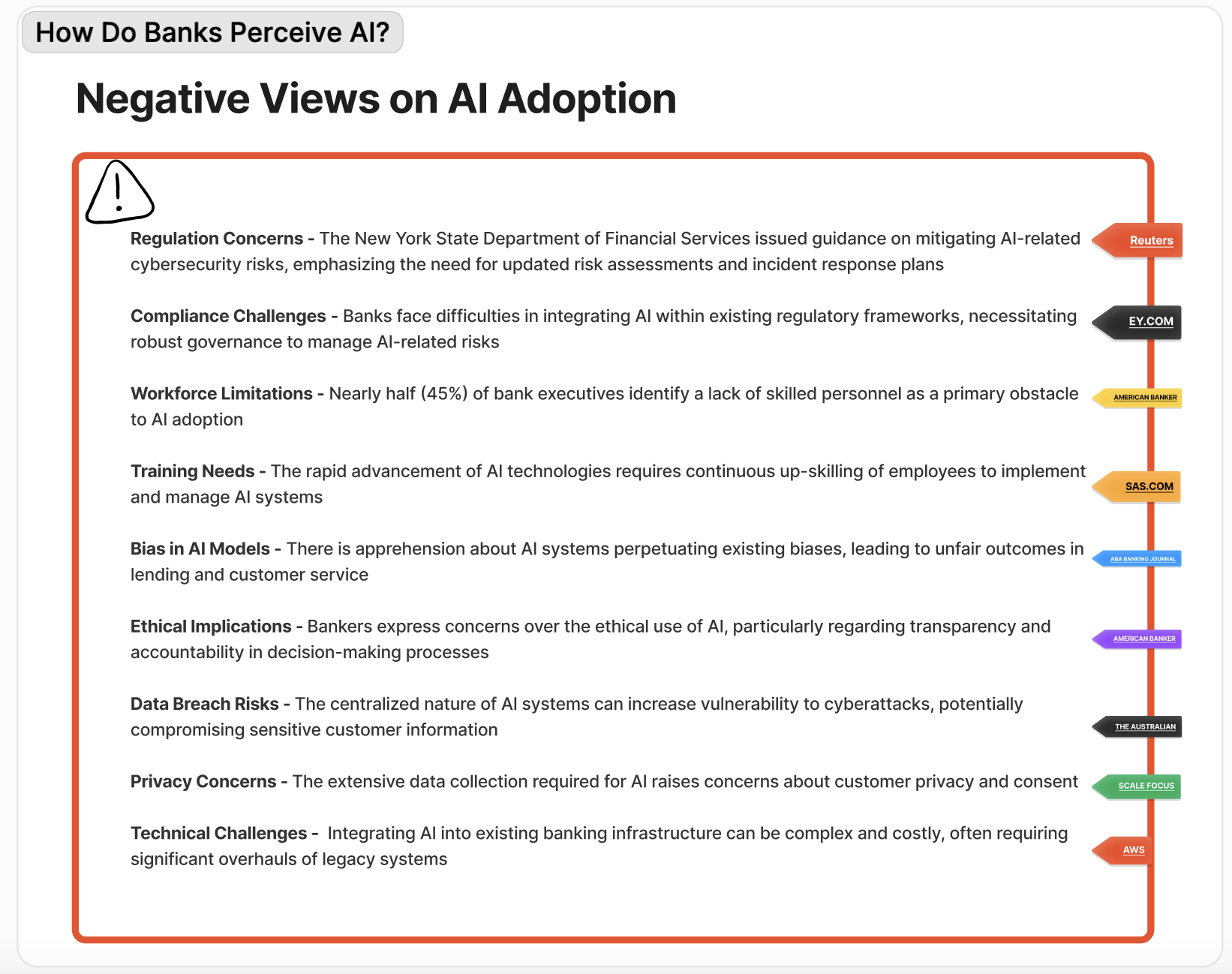

As the designer on the team for this project, I felt it was important to better understand how competitors were using AI in banking, what studies had been conducted on reception of AI within the banking industry, and how as a designer, I could help our customers embrace our new features. Over the course of 5+ months I became a subject matter expert on how AI is impacting banking (from a UX perspective).

I compiled this research to not only share with those involved in the project, but to also pass on my learnings to the other UX designers at the company.

Part 5 Development

With research and designs completed, the next phase of the project is to start the development of the pages. As of January 2025, the project is on-going with a completion date of May 2025.